It is key to have a thorough understanding of Cameroon’s economic structure and its FX and payment systems to understand the reasons for delayed payment experience.

Key notes about Cameroon

1. Cameroon is a member of the Central African Economic and Monetary Community (CEMAC). As a result, the country participates in the CEMAC currency union and has no separate legal tender.

2. Cameroon must hold at least 60% of its foreign reserves in an account in Paris that is managed by the French Treasury, which further limits the country’s leeway in financial matters.

3. Cameroon is a net importer of goods and services, and its trade balance is structurally negative and declining, reaching USD -1.6bn in 2021.

4. In, 2022 the country recorded a current account surplus of 1.6% of GDP, sustained by high commodity prices (mostly oil, but also gas, metals, minerals, and forestry) and gains in competitiveness driven by the real depreciation of the CFAF relative to the euro and US dollar. However, a current account deficit is expected in 2023.

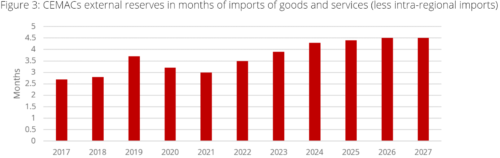

5. The regional FX reserves are slightly below (3.9 months) the IMFs benchmark (5 months) considered adequate for a resource-rich monetary union.

6. Cameroon’s payment systems are inefficient, opaque, there is no guaranteed settlement finality. Delays are common, value dates are not respected, problems and incidents (especially returned checks) are frequent.

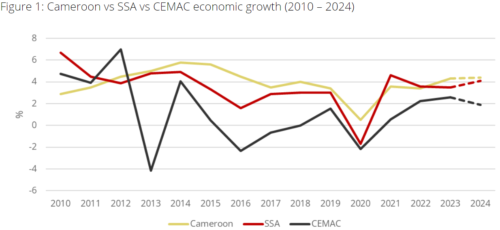

Economic growth

Cameroon is a lower middle-income, oil-exporting country. It is richly endowed with natural mineral resources, including oil, natural gas, gold, iron, and manganese.

The country has shown a relatively strong macroeconomic performance in recent years, with growth reaching 3.7% in 2019 before the Covid-19 outbreak.

Cameroon’s post-pandemic economic recovery gradually took hold, with real GDP growth recorded at 3.6% in 2021 and 3.4% in 2022, supported by high oil prices, higher oil production, and improved external demand translating into stronger private consumption and investments.

In the medium term, growth is expected to rise gradually to above 3.5%, mostly owing to a stronger rebound in the non-oil sector, as the reforms to improve governance, transparency, and business climate are projected to bear fruit progressively (see Figure 1).

Economic bloc and currency union

Cameroon is a member of the Central African Economic and Monetary Community (CEMAC). The member states include Cameroon, Central African Republic, Chad, Equatorial Guinea, Gabon, and the Republic of Congo. Cameroon is the largest economy in the CEMAC community, accounting for over 60% of reserves, over 40% of the region’s GDP, and around 55% of the population.

Cameroon participates in the CEMAC currency union and has no separate legal tender. The CFA franc is pegged to the euro at the fixed rate of CFAF 655.957 per euro. The CFAF was previously pegged to the French franc from 1948 to 1999, until the introduction of the euro in 1999.

International trade

Cameroon is open to international trade. It is a member of the Commonwealth, the Economic Community of Central African States (ECCAS), has signed the African Continental Free Trade Agreement (AfCFTA) and the free trade agreement with the European Union.

Cameroon is a net importer of goods and services, and its trade balance is structurally negative (see Figure 2). According to International Trade Centre data, Cameroon recorded a trade deficit of $2,6 bn in 2021. The trade deficit narrowed slightly in 2022 to $1.16 bn.

Cameroon’s main export commodities are fuel (oil, gas), minerals (coal, aluminium), wood, cocoa, cotton, and rubber. The country’s key imports are mineral fuels and oil, food (rice, wheat, fish, etc.), medicines, and manufactured products (vehicles, machinery, electrical and electronic equipment).

Cameroon’s main export partners are China, Italy, the Netherlands, France, Spain and India. Its main import suppliers are China, France, Nigeria, the Netherlands, Thailand, the US, and Togo.

Current account

CEMAC’s current account balance recovered steadily from the 2015 oil shock trough of -14,4% to -2.3% of GDP at end 2021, dipping temporarily to -2.9% in 2020 due to the Covid-19 pandemic.

The improvement in 2021 reflected a modest increase in national savings of 1.5% of GDP from 2020 amidst lower growth in capital formation.

Historically, the persistently negative current account balance (10-year average: -3.9% of GDP) reflects poor trade balances dominated by oil trade, structural fiscal deficits, low levels of public health expenditures, and shallow and under-developed private credit provision.

A current account surplus of 1.6% of GDP was estimated in 2022, sustained by high commodity prices (mostly oil, but also gas, metals, minerals, and forestry) and gains in competitiveness driven by the real depreciation of the CFAF relative to the euro and US dollar. After improving in 2022, the current account balance is expected to decline to -1.2% of GDP in 2023, and to average about -3.1% of GDP over the medium term.

International trade reserves

After a decline in 2020 and 2021, following the Covid-19 outbreak, regional FX reserves bounced back in 2022 and have started to build up (though still short of the desired level). Gross reserves reached 3.5 months of prospective imports at end-2022, thanks to higher oil export revenues, tighter monetary policies, and the SDR allocation.

In July 2021, the IMF’s Executive Board approved 3-year arrangements under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) for SDR 483m (about $689.5m) to support the country’s economic and financial reform program).

Cameroon’s 3-year ECF-EFF arrangements are built around 5 pillars:

(i) mitigating the health, economic, and social consequences of the pandemic while ensuring domestic and external sustainability;

(ii) reinforcing good governance and strengthen transparency and the anti-corruption framework;

(iii) accelerating structural fiscal reforms to modernise tax and customs administrations, mobilise revenue, improve public financial management, increase public investment efficiency, and reduce fiscal risks from SOEs;

(iv) strengthening debt management and reduce debt vulnerabilities; and

(v) implementing structural reforms to accelerate economic diversification, boost financial sector resilience and inclusion, and promote gender equality and a greener economy.

Regional FX reserves are forecasted to reach 3.9 months in 2023, driven by efforts to repatriate export revenues (new FX regulation), sharp increase in foreign exchange on-lending by primary banks on behalf of their extractive sector clients authorised to hold foreign exchange accounts and high crude oil prices.

The Central Bank (BEAC) also increased its policy rate three times in less than a year to respond to inflationary pressures and support reserve levels.

In addition, it reinforced its liquidity management framework, steadily scaling back weekly liquidity injections at its monetary operations window, discontinuing all three long-term liquidity injection operations upon their maturity, and gradually returning to the pre-covid liquidity management framework.

In addition, it reinforced its liquidity management framework, steadily scaling back weekly liquidity injections at its monetary operations window, discontinuing all three long-term liquidity injection operations upon their maturity, and gradually returning to the pre-covid liquidity management framework.

Banking system

The Bank of Central African States (BEAC) oversees Cameroon’s banking system and is supervised by the French Treasury, which guarantees the convertibility of the local currency at a rate of CFA 655.957 to one euro.

Cameroon must hold at least 60 % of its foreign reserves in an account in Paris that is managed by the French Treasury. BEAC sets benchmark interest rates for banking institutions and state treasuries.

The banking sector is regulated by the Central African Banking Committee (COBAC), housed in BEAC’s Yaoundé offices.

The financial institutions tend to suffer from poor quality of service, lack of innovative banking products, underperformance on local debt and unpaid loans from both commercial and individual debtors.

Methods of payment

Cameroon’s payments system is part of the CEMAC system. The system consists of two parts:

1) Clearing centres at the BEAC branches for high-volume, small-value payments and

2) Settlements through regional BEAC current accounts for large-value payments.

There are currently no sub-regional (for CEMAC countries) clearing organisations. The Central Bank executes transfer orders of account holders on its books within the CEMAC zone and abroad.

In 2008, the Central Bank implemented a regional payments system that incorporates electronic bulk payment clearing. Although the BEAC uses the SWIFT network, there are administrative delays in the international transfers it processes, and some banks use alternative routes to transfer funds to and from their correspondent accounts; individuals often avail themselves of services provided by nonbanks, such as Western Union.

The IMFs report on the observance of standards and codes (ROSC) records the following about Cameroon’s payment system:

- There is no guaranteed settlement finality,

- The payment system is not efficient and practical for participants, and there is scope for improvement in security procedures.

- Delays are common, value dates are not respected, problems and incidents (especially returned checks) are frequent.

- The strictly local clearing centre organisations, and the lack of automation are characteristics of the small payment systems that contribute to the country’s poor performance.

- The large payment system maintained at BEAC’s headquarters in Yaoundé is slow and bureaucratic, and transactions are not always executed perfectly.

- Exchange and other controls make international payments outside the zone cumbersome and slow. The consequences of this problem are illustrated by the national capital market initiative, which was forced to include payment delays of up to five days in the settlement procedures.

Foreign exchange agreement and controls

Cameroon maintains an exchange system free of restrictions on the making of payments and transfers for current international transactions, except for restrictions maintained for security reasons that have been notified to the IMF pursuant to Executive Board decision 144 152/51.

The regions Central Bank (BEAC) launched its new foreign exchange regulations in 2019 (Article 191 of the CEMAC Regulation 02/18/CEMAC/UMAC/CM).

BEAC now requires banks to surrender all foreign currency remittances to the Central Bank and to consolidate their customers’ forex requests into one application, in hard copy, to the national BEAC office. The BEAC office then clears and forwards the request to the regional office, based in Yaoundé, for final approval.

The new exchange regulations prohibit economic agents from holding accounts in offshore or onshore currencies, within CEMAC credit institutions, except for special waiver.

In practice, many banks continue to turn currency around without sending it to BEAC, processing payments for imported goods or services as soon as they receive foreign currency.

BEAC has reprimanded seven local bank general managers for failing to comply with the remittance requirements, denied any delays in their own procedures, and threatened more reprimands for banks that criticise the policy. Banks, including Ecobank, Standard Chartered, and Citi, and the business community complain that the process, which is supposed to provide the foreign currency required for outside transactions within 48 hours, takes anywhere from several days to several weeks. The IMF reported a denial rate of 30%, which BEAC blamed on non-compliance, although some banks consider the reasons for refusal opaque.

Should you need more information about Cameroon, please do not hesitate to contact us at [email protected] !